Condo Insurance in and around Ashland

Condo unitowners of Ashland, State Farm has you covered.

Cover your home, wisely

Your Search For Condo Insurance Ends With State Farm

When looking for the right condo, it's understandable to be focused on details like your future needs and home layout, but it's also important to make sure that your condo is properly covered. That's where State Farm's Condo Unitowners Insurance comes in.

Condo unitowners of Ashland, State Farm has you covered.

Cover your home, wisely

Put Those Worries To Rest

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has plenty options to keep your condo and its contents protected. You’ll get coverage options to match your specific needs. Fortunately you won’t have to figure that out by yourself. With empathy and remarkable customer service, Agent Chris Vomund can walk you through every step to help generate a plan that protects your condo unit and everything you’ve invested in.

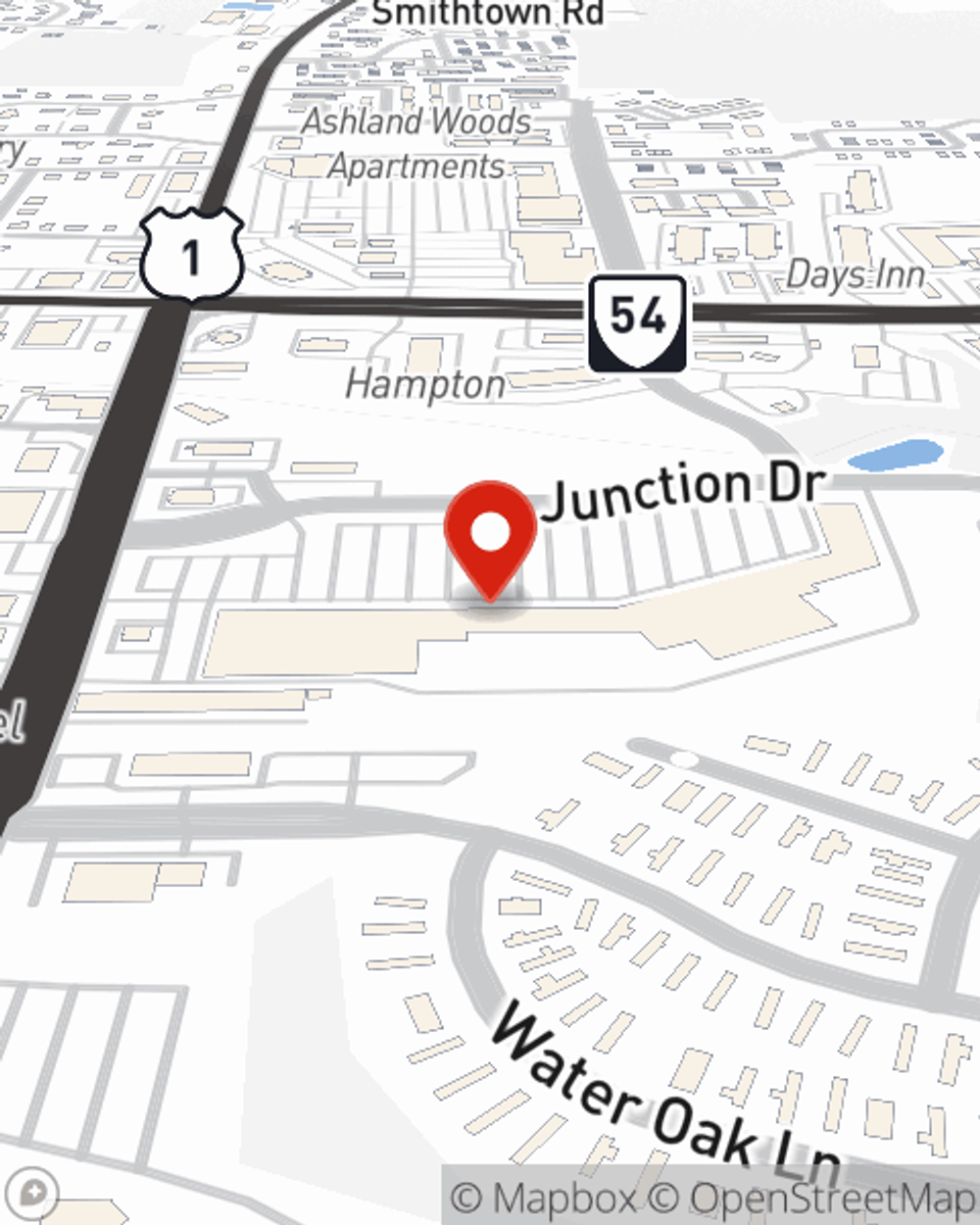

If you're ready to bundle or discover more about State Farm's outstanding condo insurance, contact agent Chris Vomund today!

Have More Questions About Condo Unitowners Insurance?

Call Chris at (804) 798-3164 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Chris Vomund

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.